Joe Duarte’s Smart Money Trading Strategy Weekly

Joe Duarte’s Smart Money Trading Strategy Weekly

By Joe Duarte Editor Joe Duarte in the Money Options

Are We All Clear? So Far So Good. Focus on What’s Working. Trade Day to Day.

April 28, 2024

With the Fed and a ton of data coming next week, anything is possible. But today, we can say that the longer the S&P holds above 5000, the higher the odds that we’ve seen the bottom for the current correction.

I’ve been among the few analysts who have been suggesting that a panic bottom might be developing. I detailed my rationale in detail here. Suffice it to say, that it’s lonely when you’re a contrarian, while if you’re proven to be correct, it’s all worth it. And what I’m seeing is that if you’re not heavily weighted in AI stocks, you’ve got a fighting chance in this market.

Are there things to worry about? As I mentioned above, we still have to get past the Fed’s next meeting (4/30-5/1, 2024), and the release of the April Non-Farm Payroll numbers. Could this be the employment report that starts to show some weakness in the labor market? Ahead of NFP, we’ll get the ADP private market data, the JOLTS job opening numbers, consumer confidence numbers, and a major PMI data dump.

Should we be bearish? Not yet. Certainly not as long as there are areas of the market which are showing bullish tendencies. Instead, it makes sense to be aware of circumstances and act accordingly.

So, are we all clear in this market? We may be getting closer. Next week will certainly shape things. Thus, while things could change rapidly, we’ll get through it by focusing on what’s working, and trading day to day.

The Big Picture

The market’s come to the realization that the Fed isn’t going to lower rates anytime soon. As a result, it’s back to business as usual, which means that daily trading is fueled by individual sector dynamics and company news. Thus, earnings news and company buybacks will fuel trading trends.

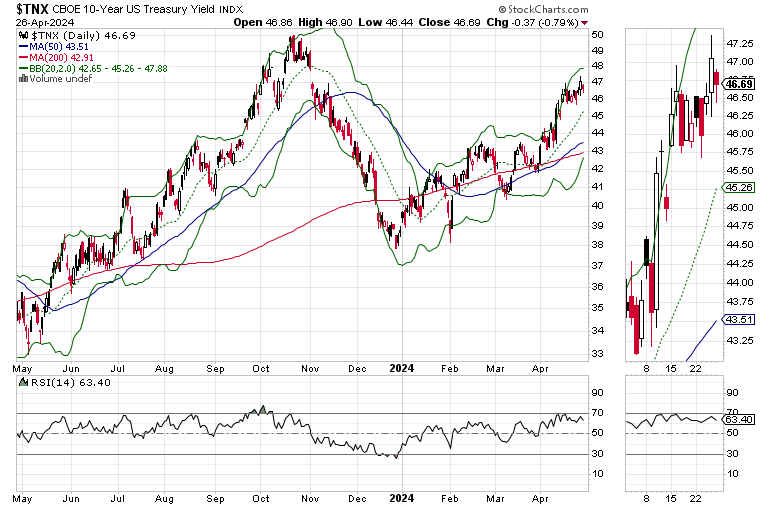

What could go wrong? A break above 4.7% on the U.S. Ten Year Note (TNX), a new geopolitical crisis, or an acceleration of the current problem areas, could certainly trigger more selling. Yet, perhaps the most difficult to gauge potential Black Swan is the U.S. election. You fill in the blanks. We don’t do politics.

Still, the current, and likely to expand wall of worry suggests that investors who stay focused and disciplined will continue to profit in this treacherous and difficult market.

Here’s our checklist on the macro environment affecting stocks and bonds this week:

- Sentiment remains bearish. The CNN Greed/Fear Index clocked in at 31 last week and is only up to 40 a week later. This remans a positive;

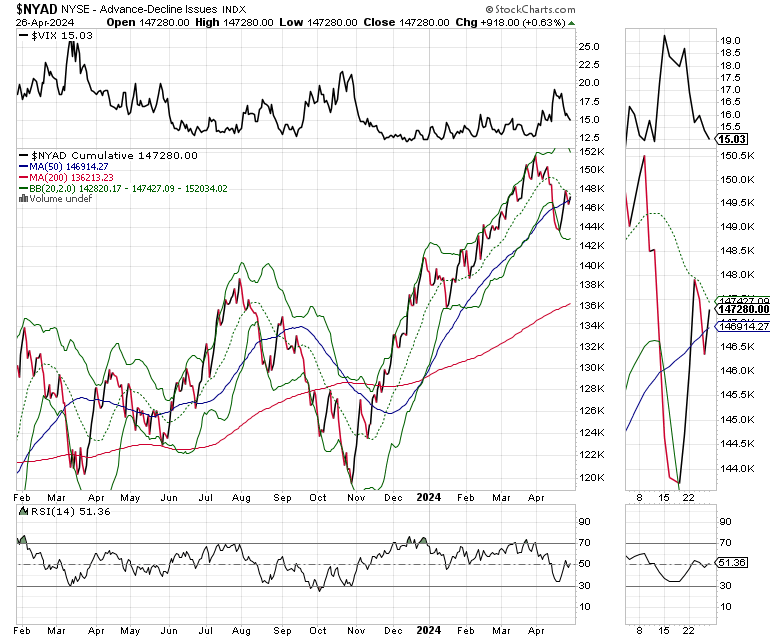

- The New York Stock Exchange Advance Decline Line (NYAD) is holding near its 50-day moving average despite bad inflation news. This is encouraging;

- The CBOE Volatility Index (VIX) failed to rise above 20. This is very encouraging;

- The Put/Call Ratio likely hit its high for the cycle on 4/17/24. This could change, but currently it is reassuring;

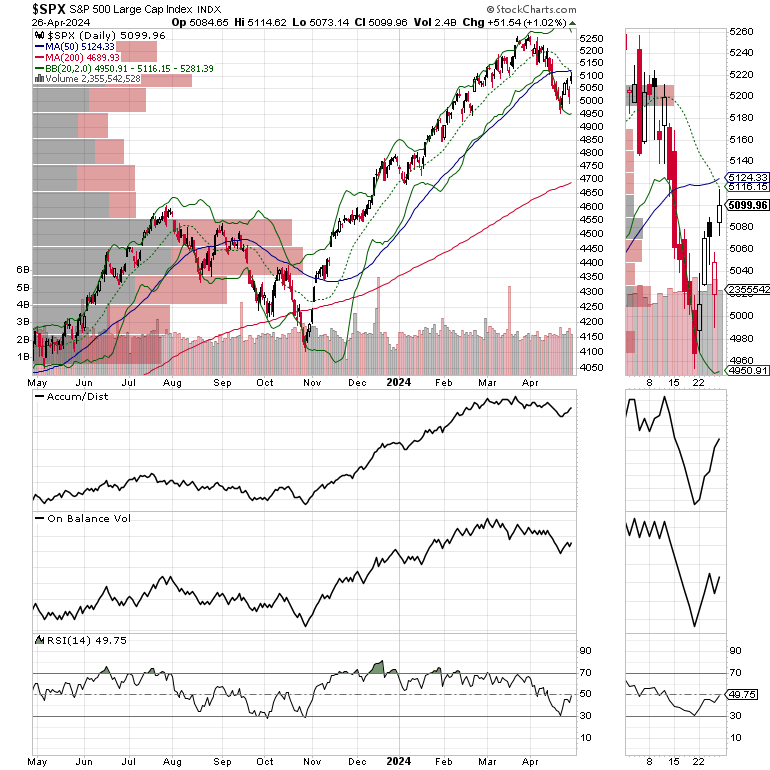

- The S&P 500 (SPX) failed to break below 4950;

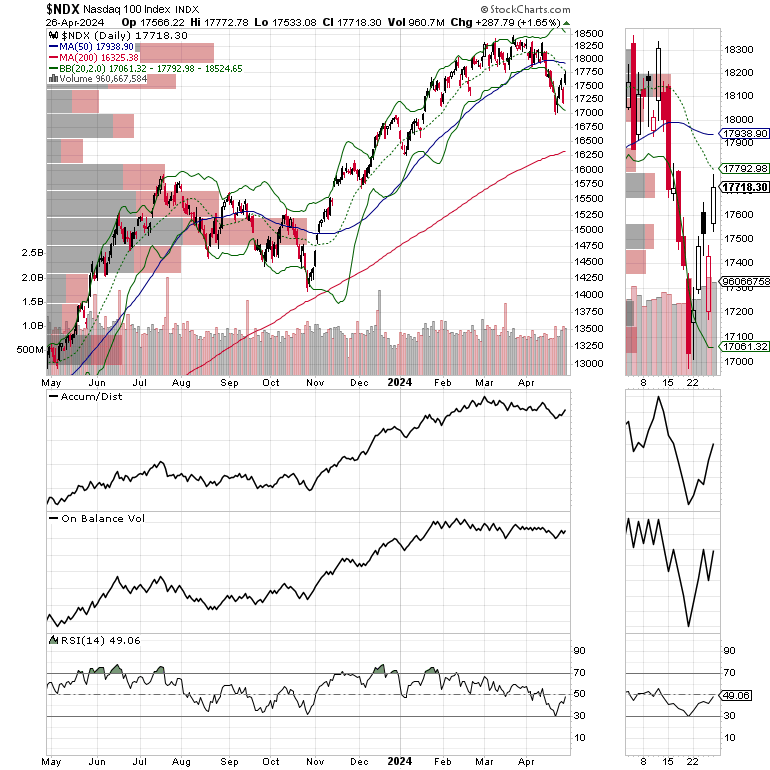

- The Nasdaq 100 Index (NDX) has also found support; and

- The U.S. Ten Year Note yield (TNX) held the key 4.7% resistance level.

To summarize: the market is moving past rate cuts and the geopolitical stalemate. It’s all about earnings and buybacks for now. Of course, in a market run by algos, in a predictably unpredictable world, anything can change at the drop of a hat.

That’s why we trade one day at a time.

Where Money is Flowing. Think the Infrastructure Megatrend.

Inflation is rising at the same time as global economies are focusing on local and regional markets. Capital flows are shifting toward the infrastructure which is required to accommodate the local construction of manufacturing plants, roads, data centers and warehouses.

This is shifting money flows in the markets to areas which are the most likely to profit from this long term megatrend. Certainly, in the post pandemic world, this is not a new concept.

What is new, is that this megatrend isn’t going away any time soon. Thus, investors who’ve been focused on traditional growth areas of the markets such as technology are under invested in the traditional cyclical industries, which are poised to become the new growth drivers.

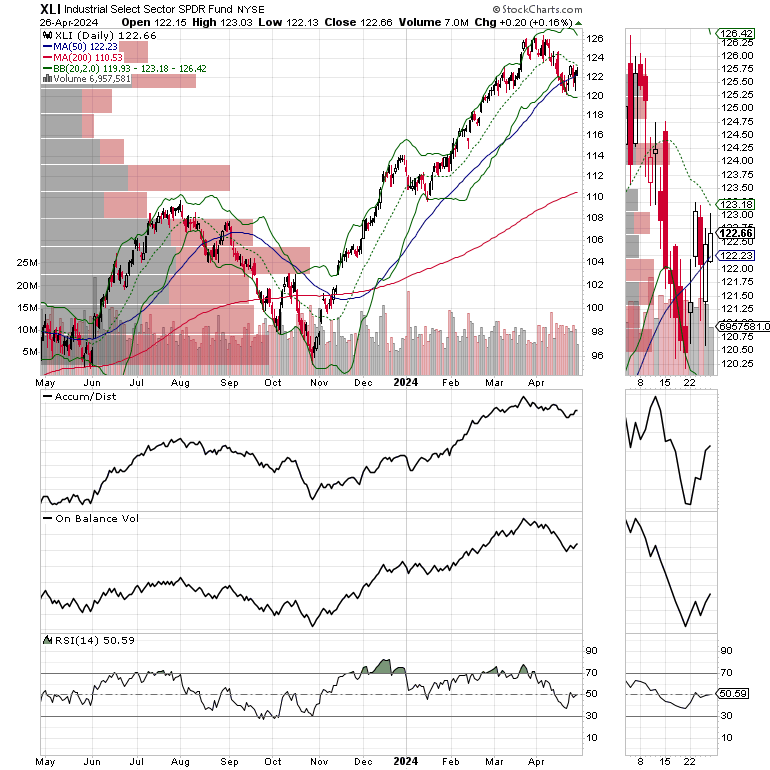

You can see this bullish money flow in the shares of the Industrial Select Sector SPDR ETF (XLI), which just crossed above its 50-day moving average after a recent pullback where investors took some profits. This bullish crossover is accompanied by a bullish turn around in both the ADI and OBV lines as short sellers (ADI) cover their bearish bets, and bullish investors move in to crush the shorts (rising OBV).

You can get an overview of how to spot a megatrend in this video. Moreover, there are several companies in this sector which are on the verge of making big moves to the upside. I just recommended two of them by Flash Alert to subscribers of Joe Duarte in the Money Options.com. You can have a look FREE of charge with a Two Week trial to the service.

This is a tough market, but it will eventually bottom out. And when it does, the rally will start with a short squeeze. In this video, I show you how to spot the price chart set up and how to trade it.

Bond Yields Fail to Break Out

Despite pesky inflation data, the U.S. Ten Year Note yield (TNX) remained range bound trading narrowly between 4.5 and 4.7%. A move above 4.7% for TNX could take yields back toward the 5% area, which would be very negative for the stock market.

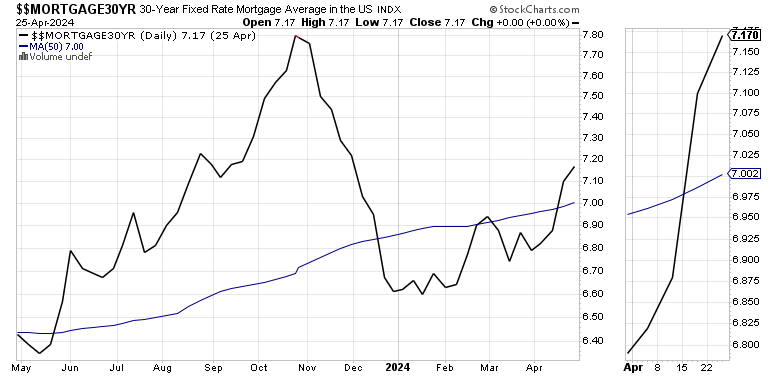

Mortgage rates, which trail bond yields by about a week, are still above 7%. Interestingly, this has not affected the homebuilder sector negatively.

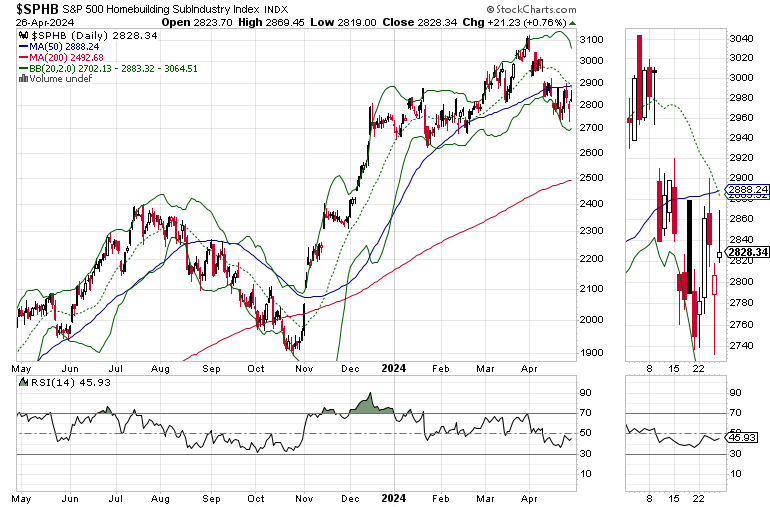

The S&P 500 Homebuilding Subindustry Index (SPHB) has been very stable despite the rise in bond yields and mortgages. This is a sign of relative strength, as bullish supply and demand fundamentals for the industry, which I described in detail in this post, continue to bolster homebuilder prospects.

No matter what the market does, I have a solution for inflation and your wallet. Grab a paycheck via actively trading stocks, via my active trader focused Substack page here. New trades are posted on Mondays.

ETFs make sense in this market as they let you trade sectors which can withstand inflation and volatility. My new service, Joe Duarte’s Sector Selector is all about ETFs and tactical trading. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here.

NYAD, SPX and NDX Recover. Test of Major Resistance Ahead.

The NYSE Advance Decline line (NYAD) is holding at the key support of its 50-day moving average after recently hitting an oversold reading of 30 on its RSI indicator. This is a bullish development, although it’s still early in the fledgling recovery.

The Nasdaq 100 Index (NDX) found support at 17,000 and now faces a test of its 50-day moving average near 18,000. ADI has turned up as short sellers cover. OBV is bottoming out, which means there could be more up side action here in the short term.

The S&P 500 (SPX) is also recovering with a pending test of its 50-day moving average straight ahead. So far, the index is trading above the 5000 area. Both ADI and OBV rolled over as buyers gave up (OBV) and short sellers hit the overdrive button (ADI). Support is scarce until the 200-day moving average.

VIX Failed to Rise Above 20. Put/Call Ratio Might Have Seen its Highs for the Cycle.

The CBOE Volatility Index (VIX), failed to rise above 20 in the recent correction. This is bullish. If VIX rises above 20, expect more volatility in stocks. A sustained move in VIX below 15 would be more bullish.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 New Release in Options Trading

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition)  Audible Audiobook – Unabridged Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

4.5 out of 5 stars 61 ratings

#1 New Release in Investment Analysis & Strategy

# 1 New Release on Options Trading

Good news! I’ve made my NYAD-Complexity - Chaos charts featured on my YD5 videos, and a few more available here.

Joe Duarte is a former money manager, an active trader and a widely

recognized independent stock market analyst since 1987. He is author

of eight investment books, including the best selling Trading

Options for Dummies, rated a TOP

Options Book for 2018 by Benzinga.com - now in its third edition, The

Everything Investing in your 20s and 30s and six other trading books.

Meanwhile, the U.S. Ten Year note yield (TNX) is trading in a The

Everything Investing in your 20s & 30s at Amazon and The

Everything Investing in your 20s & 30s at Barnes and Noble.

A

Washington Post Color of Money Book of the Month is now available.

To receive Joe’s exclusive stock, option, and ETF recommendations, in

your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.

JoeDuarteInTheMoneyOptions.com is independently

operated and solely funded by subscriber fees. This web site and

the content provided is meant for educational purposes only and

is not a solicitation to buy or sell any securities or investments.

All sources of information are believed to be accurate, or as otherwise

stated. Dr. Duarte and the publishers, partners, and staff of joeduarteinthemoneyoptions.com

have no financial interest in any of the sources used. For independent

investment advice consult your financial advisor. The analysis

and conclusions reached on JoeDuarteInTheMoneyOptions.com are the

sole property of Dr. Joe Duarte.

|