This is not a Bear Market

By Joe Duarte on June 19, 2017

If you own any of the previously high flying large cap tech or so-called

FANG stocks, you think you’re in a bear market, and you may be correct.

If you don’t, you have more likely been inconvenienced and rightly

concerned. Moreover after it’s all said and done what really matters

is whether we are still in a bull market or whether we’ve transitioned

into a bear market. And since the selling has mostly occurred in the

large cap technology sector, my only conclusion based on the available

evidence- unless something changes drastically, is we are still in

a bull market for a majority of stocks. That being said, I must tell

you it’s an old bull market as measured in years as well as being long

in the tooth in its latest leg, the post presidential election rally.

I must also add that old bull markets don’t last forever, so it’s not

a time to be unconcerned. But the real question is whether it’s a time

to sell. So, let’s have a look at the evidence.

Pick Your Poison

Generally speaking, in this market, you can make a fairly good case

for being bullish or being bearish. For example, if you’re bearish

you can point to the Federal Reserve’s most recent interest hike as

being the fourth in a series, with more likely to come – if Ms. Yellen

holds her nerve. This would be an important point for the bears since

history shows that three or more interest rate increases in a row often

precede bear markets. Meanwhile, bears can also point to softening

economic data and a general deterioration in both global and domestic

politics as reasons to be concerned, and in a fundamental sense they

have a point.

Be that as it may, if you’re a bull you can counter with the fact

that outside of technology the market’s in pretty good shape, all things

considered. Furthermore history also shows that as long as there is

gridlock in Washington and general discord in the world, stock prices

generally, and perhaps cynically, tend to rise. So what’s an investor

to do? It’s fairly straightforward - at this point, we have little

choice but to give the bulls and the bears some credit and to be vigilant.

Yet, since the ultimate truth in trading is price action, we should

also let the charts guide us.

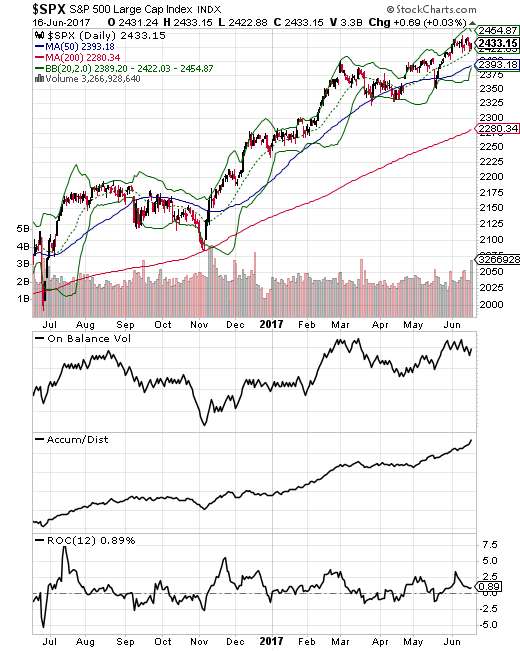

S & P 500 Holds Support

The Standard & Poor’s 500 Index of Large Cap Stocks (SPX) remains

in a very steady uptrend and is ignoring the aggressive decline in

the high tech sector, at least for now. This is partly due to the improvement

in the financial and housing stocks which have seen money rotating

into their coffers as investors run from the tech selloff.

More important from a decision making standpoint, investors should keep

in mind that as long as SPX remains above its 50-day moving average, the uptrend

for the overall market remains intact.

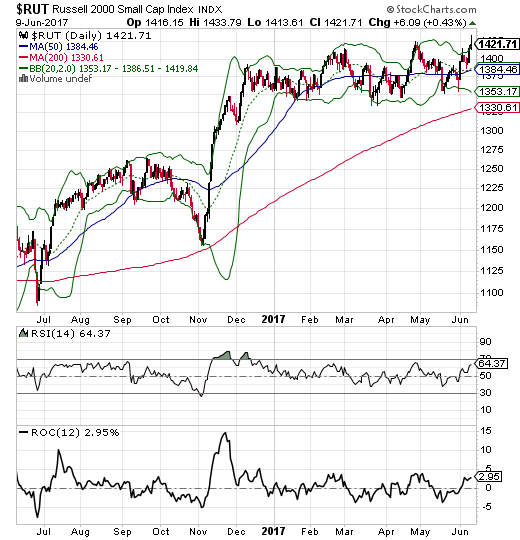

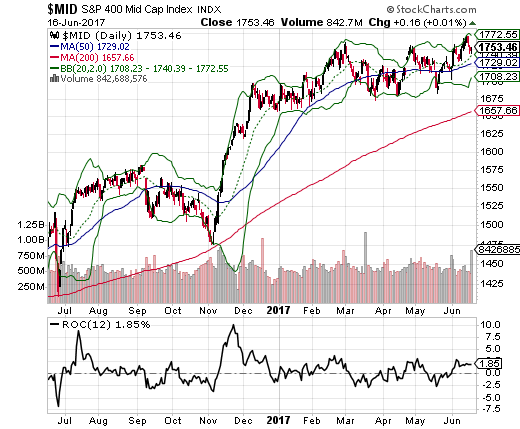

Small and Midcap Sectors Remain Stable

The large cap stocks, except technology, are still holding

up. But more surprising and encouraging is the overall steady performance of

the Russell 2000 Index of Small Stocks (RUT) and the S & P Midcap 400 (MID)

indexes.

The small stock area of the market has seen support from the financial

sector as many regional bank stocks are still attractive due to their

dividends and their general tendency to remain stable during periods

of market turbulence.

And while the action in the Russell 2000 is encouraging, I like the action

in the midcap sector a little better due to its weight toward healthcare

and IT software stocks. Indeed, while the big name tech stocks have been

hammered the smaller software stocks in MID have actually been moving sideways

and some are starting to see some signs of buying on the dip. And the same

can be said for some niche plays in healthcare.

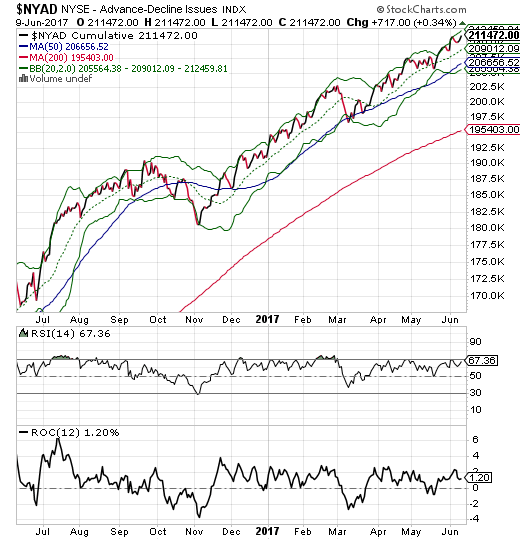

Market Breadth Remains Bullish

Regular readers know my affinity for the New York Stock Exchange

Advance-Decline line (NYAD), the line which records the difference

between advancing and declining stocks on the NYSE. When this line

rises, as it is doing at the moment, the market is in an uptrend. Moreover,

a rising AD line is a sign of positive liquidity, or money moving into

stocks. Indeed, despite the somewhat scary fundamentals in the political

arena and the selling in the large cap technology sectors, the NYAD

is just off of its recent highs, signaling a liquid market with an

uptrend, and an upward bias.

I understand. No indicator is perfect, but the NYAD is as good as it gets.

So I am encouraged by the action in the market’s breadth and its indication

of potentially higher prices ahead. Let me put it this way: in thirty years

of trading I can’t remember a bear market having started without weakness

in the advance decline.

Is This Time Different?

I don’t want to sound like I am the world’s greatest bull market cheerleader.

I’m not. I’m a trader. But I am also big fan of studying history. Thus I

want to be on record as saying I recognize we are living in unprecedented

times where the unthinkable is the norm. Specifically, for all I know, we

can enter a bear market from hell tomorrow. Yet, going on what I know today,

especially the current technical indicators in this market, this- is- not

-a -bear market.

What will change my mind? For one, a breakdown in the NYAD Advance Decline

line would be a sign of worse things to come. Secondly, if the S & P

500 breaks below its 50-day moving average convincingly, and takes the Russell

2000 and the Midcap 400 with it, I might become a rapid believer that the

bull market is in clear and present danger.

JoeDuarteInTheMoneyOptions.com is independently

operated and solely funded by subscriber fees. This web site and

the content provided is meant for educational purposes only and

is not a solicitation to buy or sell any securities or investments.

All sources of information are believed to be accurate, or as otherwise

stated. Dr. Duarte and the publishers, partners, and staff of joeduarteinthemoneyoptions.com

have no financial interest in any of the sources used. For independent

investment advice consult your financial advisor. The analysis

and conclusions reached on JoeDuarteInTheMoneyOptions.com are the

sole property of Dr. Joe Duarte.

|