Joe Duarte’s Smart Money Trading Strategy Weekly

By Joe Duarte Editor Joe Duarte in the Money Options

No One Believes in this Rally. That’s Great News. Don’t Fight the Fed.

May 5, 2024

Expect a bumpy ride, as the bottoming process continues in stocks.

But here’s the bullish side. The level of unbelief in the unfolding rally in stocks is palpable. And yes, everything could easily unravel in an instant. But from a trading standpoint, the best approach is to trade what you see and to trust the price charts, especially when the Fed is telling you, even indirectly, that it’s back in easing mode.

What could change the current scenario? Sustained momentum failures at S&P 500 (SPX) 5150 and U.S. Ten Year Note Yield (TNX) 4.5%. Still, current trading history suggests that it would take a lot of selling pressure to hit new lows in stocks and new highs in yields.

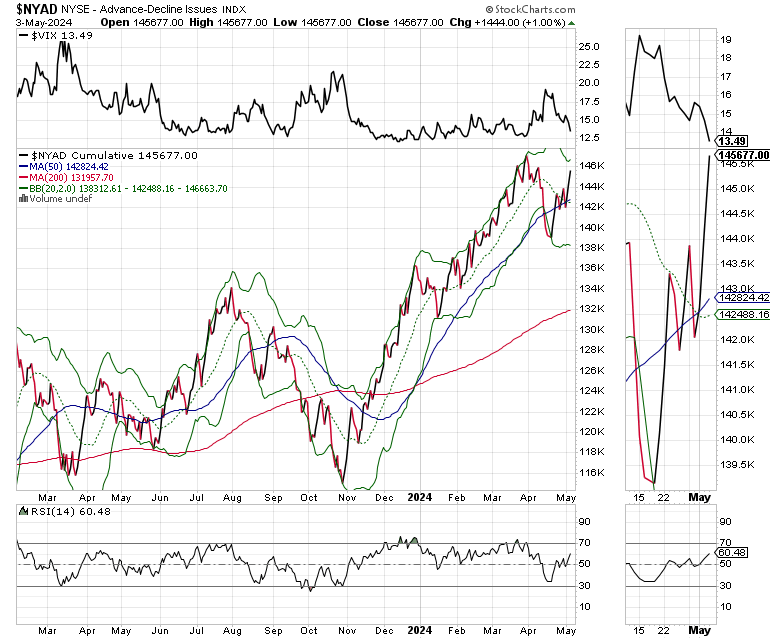

So, until proven otherwise, we trade the long side in the sectors which offer the best risk/benefit ratio. Indeed, the most encouraging sign in this market is the outperformance of the market’s breadth, as in the action of the New York Stock Exchange Advance Decline line (NYAD), as I describe below.

Don’t Fight the Fed as it Throttles Back its Selling Pressure on the Bond Market

It’s hard to be bullish when everything looks awful. But history shows that it’s often when things seem to be at their worst that markets move higher. This is especially true when the Fed starts a new easing cycle, even if it’s through the back door.

SPECIAL SUBSCRIPTION OFFER

1. Over Twenty-nine Years of Trading Experience

2. Now Joe is bringing all his years of expertise to his new options focused web site with two goals: Risk Management and Profit Delivery.

3. Weekly market analysis and portfolio updates gives you the big market picture.

4. Joe has designed and fully tested a select group of easy to follow and deploy option strategies coupled with on- point stock and ETF picks focusing primarily in the biotech, healthcare, and technology sectors.

5. In depth individual position technical and fundamental analysis.

6. Unlimited intraday buy and sell alerts as called for by market and individual positions.

SUBSCRIBE NOW BY CLICKING HERE

CLICK HERE NOW! |

|

|

TThere are no guarantees. Yet, it’s hard to ignore what’s happened.

The Federal Reserve has started the easing cycle through the back door by reducing the number of bonds it will sell into the markets – a reversal of its QT (qualitative tightening) process. This takes pressure off market interest rates (loans, and mortgages) and gives bond traders a reason to buy bonds, since their value is likely to remain more stable, or even rise as the biggest bond seller in the world, the Fed is reducing its selling from $60 billion per month to $25 billion. Think of it as if $45 billion pounds of pressure has been lifted from the bond market.

And why shouldn’t the Fed ease back on the QT throttle?

The Employment Cost Index (ECI) showed rising wage pressures. Yet, PMI data, regional and national showed all categories falling except prices paid. Both ISM and PMI numbers showed a slowing in new orders, production, and a fall in back order logs. Unfortunately, prices continue to move higher.

Even if the ADP Private Payroll data came in stronger than expected, there was a marked decrease in tech sector jobs. In addition, the JOLTS job openings data came in below expectations, with a decline in the number of people quitting present jobs, being hired, or looking for new jobs, as fear of not finding a new job is on the rise.

Finally, NFP missed on new jobs and showed that wage pressures are slowing, countering the data from other sources.

Short Squeeze Setting Up in Housing ETF

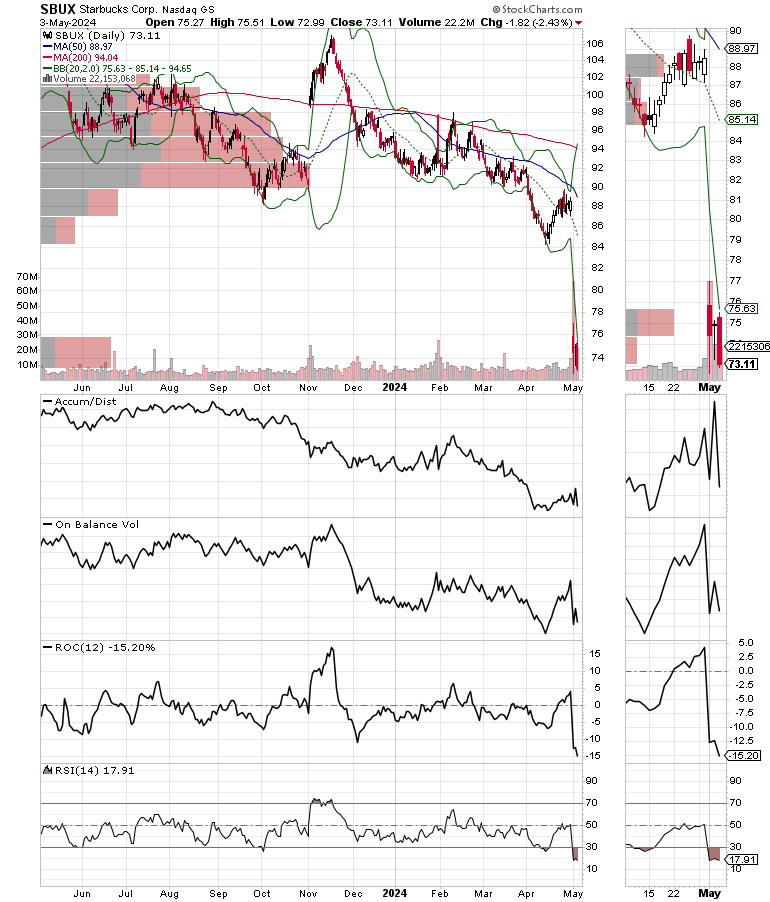

The changing landscape in the economy is shifting money flows in the markets and earnings for restaurants tell the story. Big earnings misses from Mc Donald’s (MCD) and Starbucks (SBUX) signal an across the board struggling consumer.

Starbucks (SBUX), a place well known for its expensive coffees is suddenly in shambles as mid to upper level consumers aren’t willing to fork out $5-$8 for a latte’ which they can make at home for less than $1. The world’s largest coffee chain missed badly on all its metrics and did not give any sign that things are about to turn around.

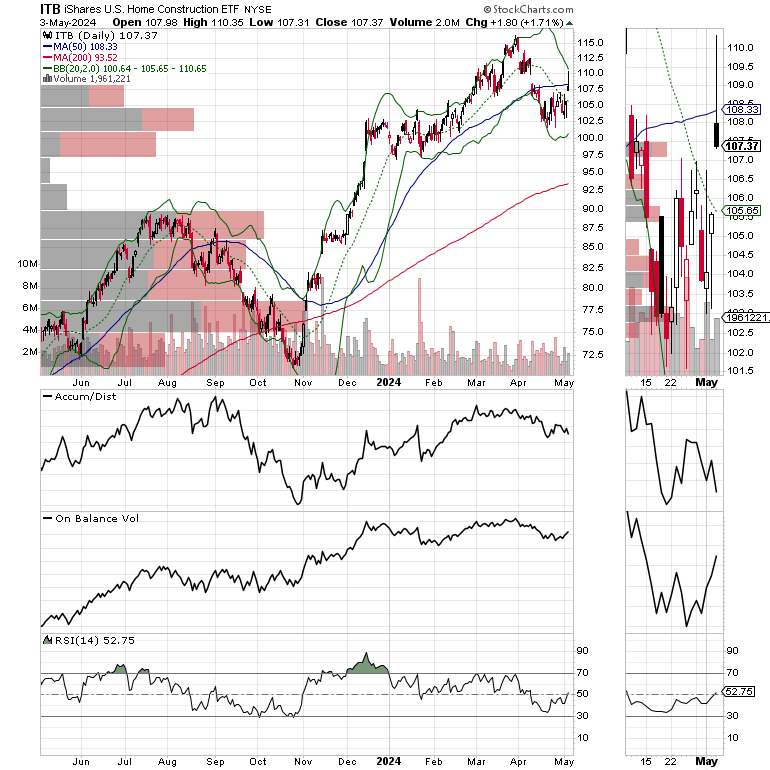

Meanwhile, money coming out of beleaguered stocks is moving into other areas of the market, especially homebuilders which are primed for a short squeeze.

Homebuilders spiked higher on the fall in bond yields as traders factor in potential buyers coming in off the sidelines in response to a drop in mortgages. The iShares U.S. Home Construction ETF (ITB) is challenging key resistance and is setting up for a short squeeze. I’ve been adding homebuilders to the portfolios at Joe Duarte in the Money Options.com for the last few weeks. Those trades are starting to pay off. Check them out with a FREE Two Week Trial to the service here.

SPECIAL SUBSCRIPTION OFFER

1. Over Twenty-nine Years of Trading Experience

2. Now Joe is bringing all his years of expertise to his new options focused web site with two goals: Risk Management and Profit Delivery.

3. Weekly market analysis and portfolio updates gives you the big market picture.

4. Joe has designed and fully tested a select group of easy to follow and deploy option strategies coupled with on- point stock and ETF picks focusing primarily in the biotech, healthcare, and technology sectors.

5. In depth individual position technical and fundamental analysis.

6. Unlimited intraday buy and sell alerts as called for by market and individual positions.

SUBSCRIBE NOW BY CLICKING HERE

CLICK HERE NOW! |

|

|

The United States Natural Gas Fund (UNG), in which I recently recommended an option play at Joe Duarte in the Money Options.com, is putting what looks to be a very credible trading bottom. Note the encouraging action in both the ADI and OBV lines as short sellers (ADI) bail out and buyers are starting to move in (OBV).

In this video, I show you how to spot the price chart set up for short squeezes and how to trade it.

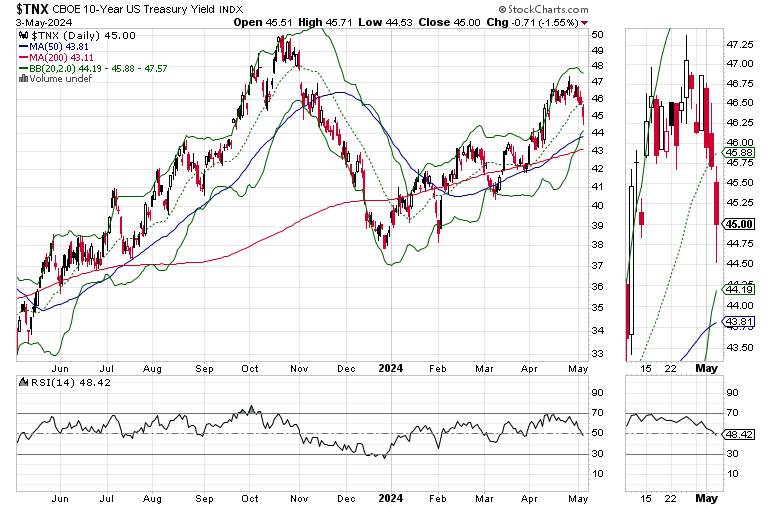

Bond Yields Test 4.5%. New Downside Target is Now 4.4-4.5%. Expect a Surge in Homebuyer interest as Mortgage Rates Drop Next Week.

The U.S. Ten Year Note yield (TNX) is testing the bottom of the 4.5-4.7% range. TNX is now setting up a test of its 50 and 200-day moving averages with the new support area to consider being 4.4-4.5%. A move below this key support range would likely be bullish for stocks, especially homebuilders. A move above 4.7% for TNX could take yields back toward the 5% area, which would be very negative for the stock market.

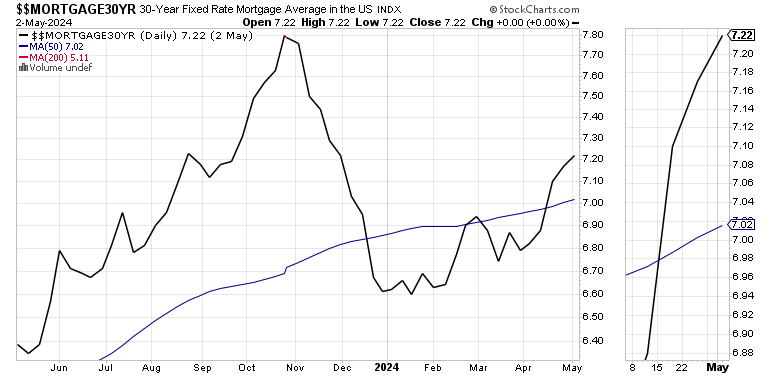

Mortgage rates, rose dramatically AGAIN last week. But remember, this chart is based on old data. If there is no backup in rates over the next week, we may see mortgages testing the 7% level on the down side. That would be bullish for homebuilders.

No matter what the market does, I have a solution for inflation and your wallet. Grab a paycheck via actively trading stocks, via my active trader focused Substack page here. New trades are posted on Mondays.

ETFs make sense in this market as they let you trade sectors which can withstand inflation and volatility. My new service, Joe Duarte’s Sector Selector is all about ETFs and tactical trading. It’s FREE with your monthly membership to Buy Me a Coffee. Sign up here.

NYAD, SPX and NDX Recover. Test of Major Resistance Ahead.

The NYSE Advance Decline line (NYAD) rallied nicely after holding at the support of 50-day moving average. It’s closing in on a new potential high. A new high on NYAD would be very bullish.

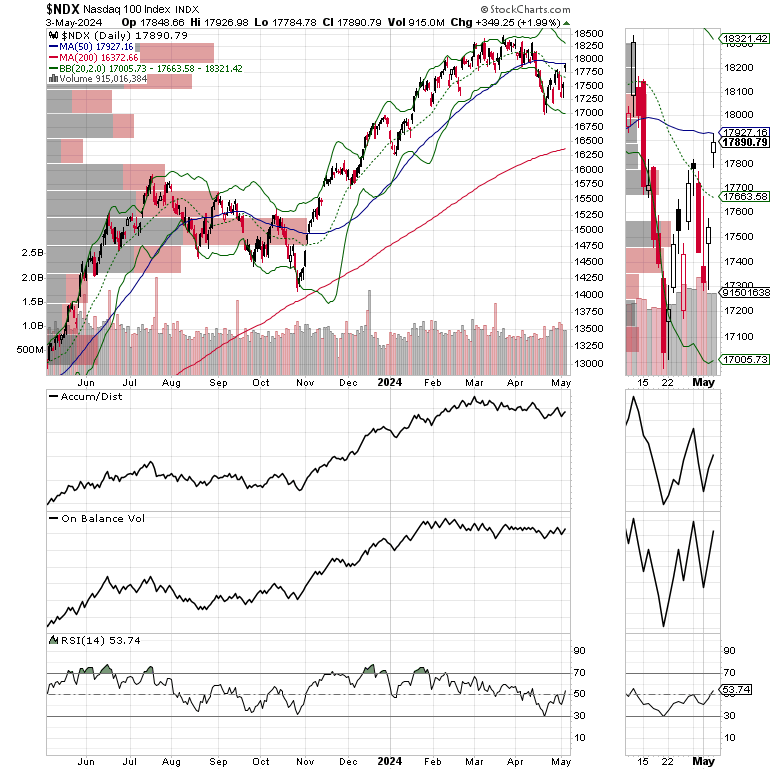

The Nasdaq 100 Index (NDX) found support at 17,000 is testing its 50-day moving average near 18,000. ADI has turned up as short sellers are concerned. OBV is bottoming out, which means there could be more upside action here in the short term.

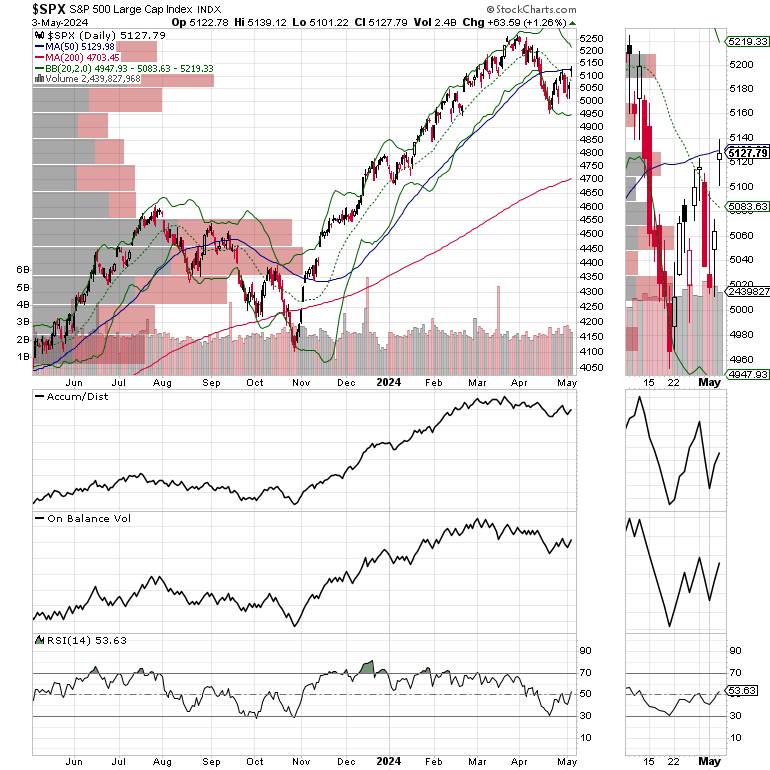

The S&P 500 (SPX) is still testing its 50-day moving average but holding well above 5000. Both ADI and OBV have stabilized. SPX has good support from a VBP bar in the current trading range as well.

VIX Rolls Over.

The CBOE Volatility Index (VIX), failed to rise above 20 in the recent correction and has now rolled over. This is bullish. If VIX rises above 20, expect more volatility in stocks. VIX is back below 15 which is bullish.

VIX rises when traders buy large volumes of put options. Rising put option volume leads market makers to sell stock index futures to hedge their risk and leads markets lower. A fall in VIX is bullish signaling lower put option volume, eventually leads to call buying which is bullish as it causes market makers to buy stock index futures raising the odds of higher stock prices.

To get the latest up to date information on options trading, check out “Options Trading for Dummies”, now in its 4th Edition – Available Now!

#1 New Release in Options Trading

Now in Audible Audiobook Format

Options Trading for Dummies (4th Edition)  Audible Audiobook – Unabridged Audible Audiobook – Unabridged

Joe Duarte MD (Author), Terrence Kidd (Narrator), Tantor Audio (Publisher)

4.5 out of 5 stars 61 ratings

#1 New Release in Investment Analysis & Strategy

# 1 New Release on Options Trading

Good news! I’ve made my NYAD-Complexity - Chaos charts featured on my YD5 videos, and a few more available here.

Joe Duarte is a former money manager, an active trader and a widely

recognized independent stock market analyst since 1987. He is author

of eight investment books, including the best selling Trading

Options for Dummies, rated a TOP

Options Book for 2018 by Benzinga.com - now in its third edition, The

Everything Investing in your 20s and 30s and six other trading books.

Meanwhile, the U.S. Ten Year note yield (TNX) is trading in a The

Everything Investing in your 20s & 30s at Amazon and The

Everything Investing in your 20s & 30s at Barnes and Noble.

A

Washington Post Color of Money Book of the Month is now available.

To receive Joe’s exclusive stock, option, and ETF recommendations, in

your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.

JoeDuarteInTheMoneyOptions.com is independently

operated and solely funded by subscriber fees. This web site and

the content provided is meant for educational purposes only and

is not a solicitation to buy or sell any securities or investments.

All sources of information are believed to be accurate, or as otherwise

stated. Dr. Duarte and the publishers, partners, and staff of joeduarteinthemoneyoptions.com

have no financial interest in any of the sources used. For independent

investment advice consult your financial advisor. The analysis

and conclusions reached on JoeDuarteInTheMoneyOptions.com are the

sole property of Dr. Joe Duarte.

|